M&A in CEE - Ed.#6

The Sixth Edition of M&A Teaser in CEE Has Arrived: Merger Control in Poland, GESSEL’s 2022 M&A Yearbook and Insights on the Recent Top Deals

Chembers’ Merger Control 2023 - Poland Trends and Developments

Overview:

The Polish merger control landscape witnessed significant developments in 2022, with notable court challenges to the decisions of the Polish Competition Authority (PCA). This marks a departure from the usual limited role of courts in merger control matters.

Merger Notification and Enforcement:

-Merger notifications regulated by the Act of 16 February 2007 on Competition and Consumer Protection.

-Notifications required for acquisitions of control, mergers, asset purchases, or joint ventures meeting turnover thresholds.

-Simple cases cleared in Phase I within a month; complex cases extend to Phase II with a possible four-month extension.

-Despite double-digit inflation, turnover thresholds remained unchanged, broadening the scope of notifications.

PCA's Role and Leadership:

-PCA's enforcement of competition rules, including merger control, remains strong under Tomasz Chróstny's leadership.

-ECN+ Directive implementation led to Chróstny's renewed five-year term.

-Recent rulings suggest PCA's actions could be curbed by courts on appeal.

Formalisation of Merger Proceedings:

-A rise in cases held with over 300 proceedings in 2022 and expected in 2023.

-Proceedings taking longer due to an influx of inexperienced staff and PCA's thorough approach.

-PCA becomes stricter with notification contents and supporting documentation, issuing more requests for information (RFIs).

Foreign Direct Investment Review:

-FDI review introduced during the COVID-19 pandemic to protect key Polish businesses.

-FDI review extended for three years; exempts investors from OECD countries.

-PCA reviews FDI cases alongside merger control; increased FDI cases expected due to Ukrainian investments.

Recent PCA Decisions and Court Judgments:

-2022 had relatively few significant merger control decisions; one conditional approval, no outright forbiddance.

-PCA's interpretation of foreign-to-foreign joint ventures confirmed; review of activity changes in joint ventures.

-Court judgments involving PCA: Agora/Eurozet case overturned PCA's prohibition decision due to lack of substantiated harm.

-Nord Stream 2 case saw Competition Court annul PCA's decision; court emphasized strict standards of evidence and law.

Implications:

These developments underscore a shifting landscape in Polish merger control, where courts are playing a more active role and emphasizing the need for well-researched, substantiated decisions by the PCA. The outcomes of the Agora/Eurozet and Nord Stream 2 cases highlight the importance of adhering to high standards of evidence and analysis in merger control proceedings.

GESSEL’s M&A Yearbook 2022

GESSEL's 2022 M&A Highlights

-30 successful M&A transactions completed

-5th rank in Poland for M&A activity per MergerMarket

-Total transaction value reaches EUR 0,8 billion

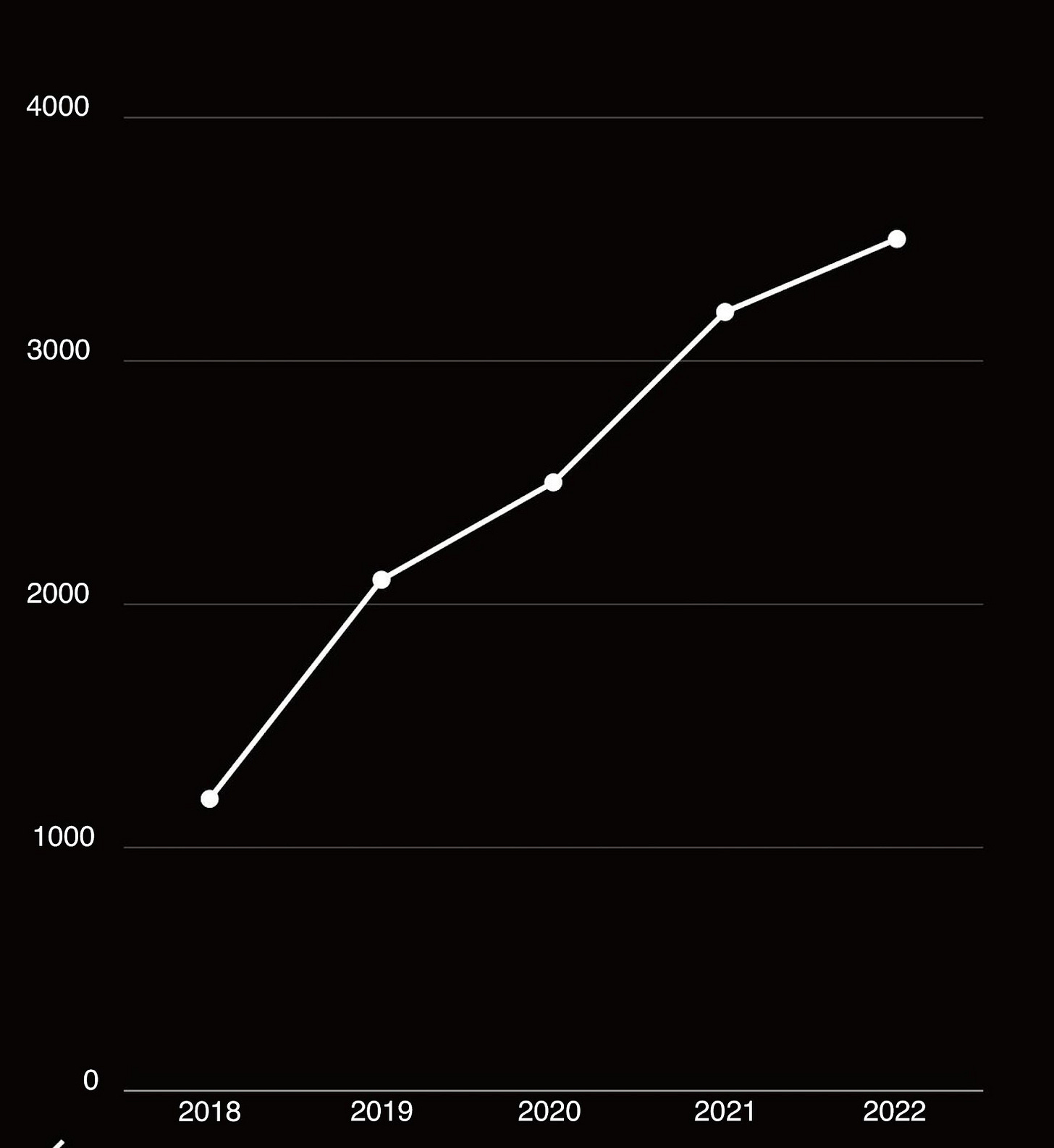

Upward trend in Transaction Value (in PLN millions)

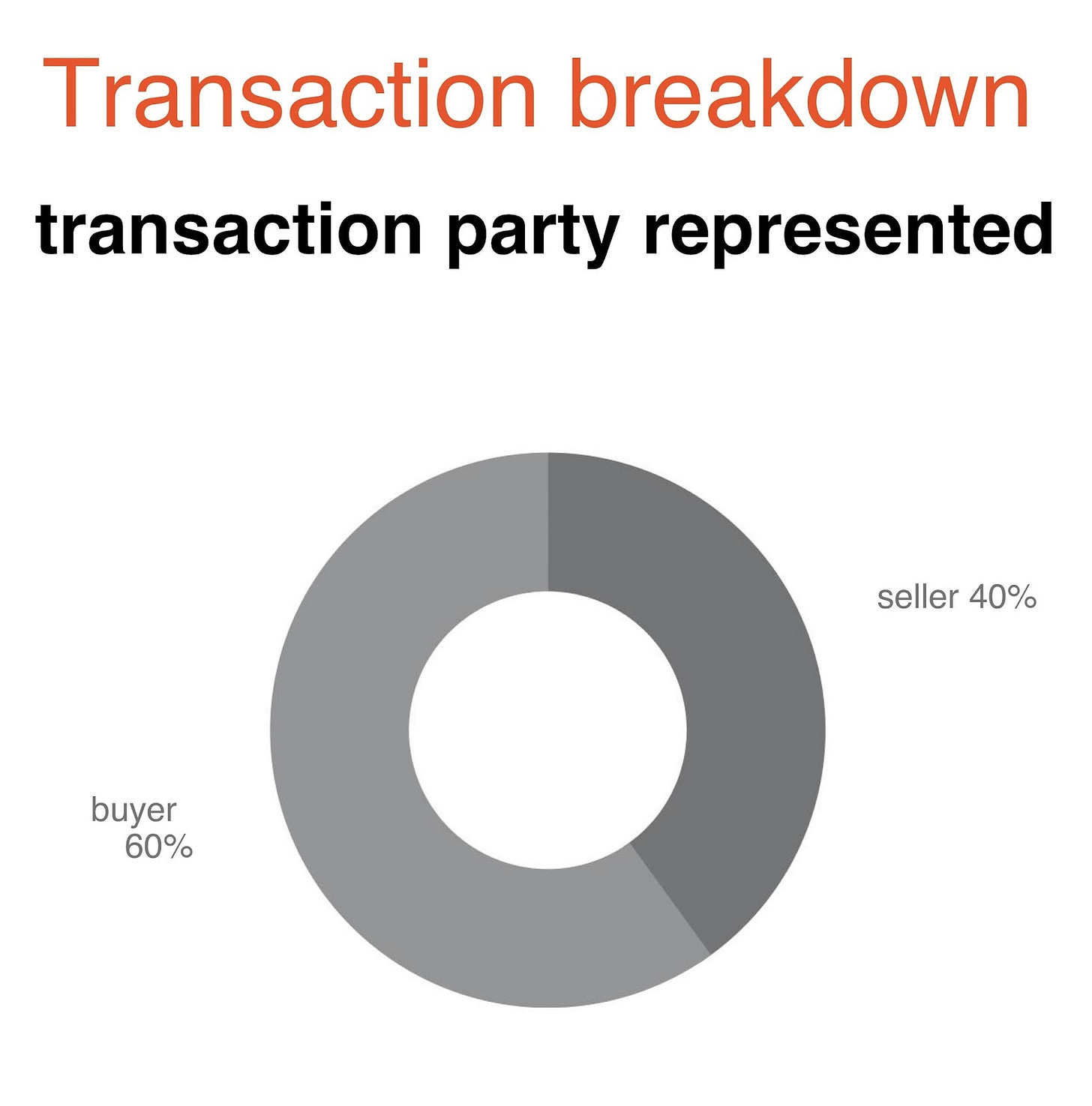

In 2022, 40% of GESSEL’s transactions were sell-side deals, while 60% were buy-side transactions. In 2021, the sell-buy ratio was 48/52, and in 2020, it was 52/48.

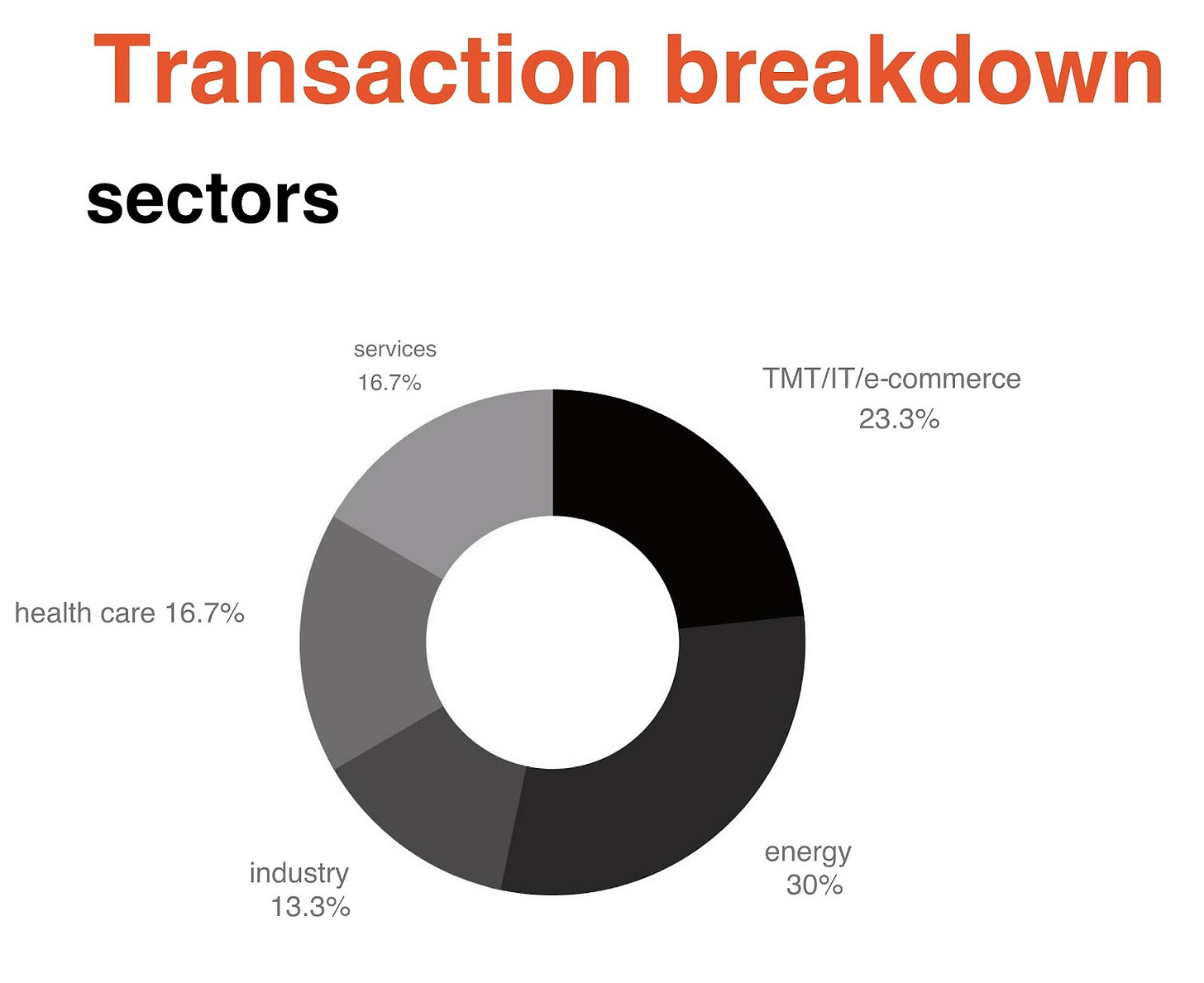

In 2021, GESSEL provided advice on diverse transactions across multiple sectors, with the TMT/IT sector (29%) holding the largest market share, followed by healthcare and industry (both at 19%).

In 2022, GESSEL’s advisory shifted towards the energy sector, with 30% of all transactions falling under this category. TMT/IT remained a strong position at 23.3%. The shift towards energy in 2022 reflects the growing interest in renewable energy sources to meet the increasing energy demand.

This trend is likely to continue in 2023 and beyond, as entrepreneurs strive to position themselves for future growth in the rapidly evolving global energy landscape.

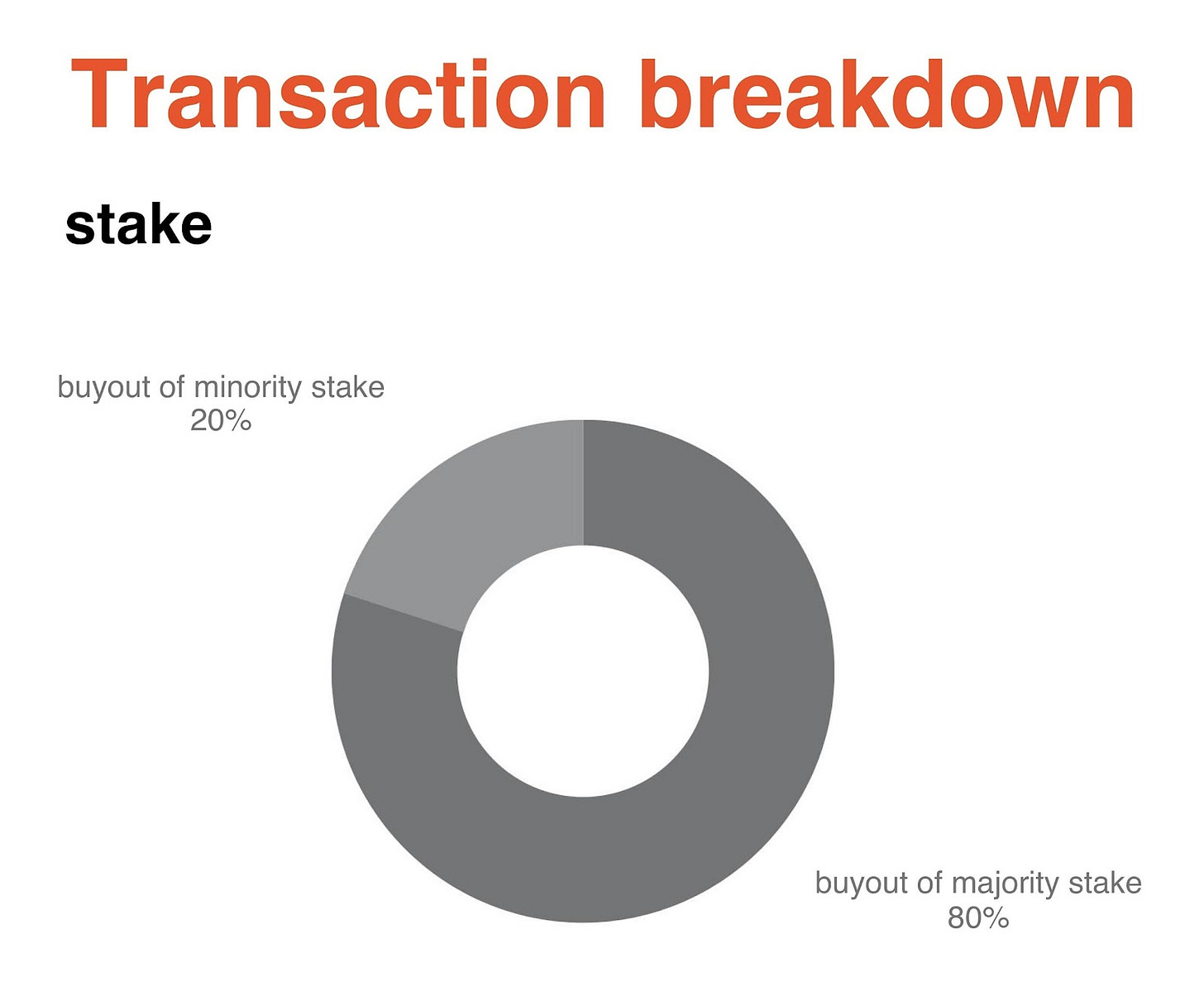

In 2022, GESSEL primarily advised on transactions related to majority stakes, which accounted for 80% of our transactions, compared to 68% in the previous year.

The M&A Community is supported by iDeals Virtual Data Room. If you have any initiatives and want to be part of this community, contact us:

elena.frolova@idealscorp.com

If anyone from your team needs to set up a VDR for a transaction, don't forget to share Elena’s email elena.frolova@idealscorp.com

You also can schedule a quick call using the link below:

🇵🇱EDP Renewables Polska (EDPR) has been advised by DLA Piper on the sale of a 142 MW Polish wind portfolio, along with potential hybrid solar projects, to Orlen Wind 3 sp. z o.o., a company owned by Orlen S.A., for approximately EUR 0.49 billion, as part of EDPR's EUR 7 billion asset rotation program.

🇵🇱EP Equity Investment has acquired 100% of Atos SE's Tech Foundations business for an enterprise value of EUR 2 billion. Gide provided legal counsel for the transaction

🇧🇬🇭🇺🇷🇸🇸🇰Emirates Telecommunications Group Company (e&), supported by Schoenherr and Sullivan & Cromwell London, is acquiring a controlling stake in PPF Telecom Group's assets in Bulgaria, Hungary, Serbia, and Slovakia. The deal is valued at EUR 2.15 billion, with Schoenherr leading the advisory team.

🇵🇱A consortium of financial institutions, composed of Bank Gospodarstwa Krajowego, Bank Pekao S.A., Alior Bank S.A., KfW IPEX-Bank GmbH and Erste Group Bank AG, advised by Clifford Chance on the financing of a 750 MW Combined-Cycle Gas Turbine (CCGT) power plant project in Ostrołęka, Poland with value of EUR 0.55 billion.

Top Deals by country

•LyondellBasell Industries NV has acquired the Mepol Group, which includes Italian companies Mepol Srl and Polar Srl, along with the Polish company Industrial Technology Investments Poland sp. z o. o. Wardyński & Partners advised on the Polish aspects of the transaction.

•EcoWipes, a prominent Polish manufacturer of personal care products, has been successfully sold to an investor controlled by Cornerstone Investment Management and Kartesia. The transaction was advised by Clifford Chance.

•Penta Investments' private equity fund, represented by MJH Law Firm, has successfully facilitated the sale of a 50% stake in Iglotex to the Wlodarczyk family, founders of the Iglotex group.

•Customs Support Group has acquired shares in Rusak Business Services, a prominent Polish customs broker, with legal guidance provided by Wolf Theiss.

•Romanian construction holding company Roca Industry is in advanced talks to acquire a stake in Workshop Doors, a local interior door manufacturer. The potential transaction, to be carried out through Roca's subsidiary Eco Euro Doors, is subject to internal evaluation and regulatory approvals.

•The InPost Group has acquired a 30% equity stake in Menzies Distribution Group Limited for EUR 57.2 million, with Greenberg Traurig advising the InPost Group on the transaction. The deal also includes a three-year option to acquire the remaining 70% equity stake.

•Samvardhana Motherson Automotive Systems Group BV (Motherson) is set to acquire 100% of Dr. Schneider Automotive Polska sp. z o. o., facilitated by legal advisory from DZP, as part of Motherson's global strategy to acquire Schneider Group companies.

•Wirtualna Polska Holding has successfully acquired the remaining shares and subscription warrants of Audioteka, a Warsaw-based audiobook service, for nearly EUR 17 million, solidifying its ownership at 100%.

•IMCD NV, a prominent supplier of specialty chemical products, has acquired a 90% stake in O&3 Limited, a major producer of specialty natural ingredients for the cosmetics and personal care markets. DZP provided advisory services.

•Transport Trade Services (TTS) has acquired a 99.9% stake in Constanta port operator Decirom for EUR 21.8 million, with legal advisory provided by Zamfirescu Racoti Vasile & Partners.

•CEC Bank, Romania's state-owned savings bank, has successfully acquired a 99.993% stake in the Rural Credit Guarantee Fund (FGCR) from BRD Groupe Societe Generale, Banca Comerciala Romana (BCR), and Raiffeisen Bank, with a strategic focus on boosting support for agriculture and rural areas.

•SFC Solutions Automotive Romania, a prominent automotive-parts producer, has been advised by Kinstellar in a sale-and-leaseback deal involving the transfer of its industrial site to Belgian logistics property developer WDP Romania.

•ROMCIM, a CRH Company, has been advised by Schoenherr Romania on merger clearance and FDI filing for its acquisition of Bauelemente Reinvest and its branch, adding three production facilities to its Romanian business.

•PWO Group, a global technology leader in metal components and subsystems for the mobility industry, has expanded its toolmaking capacities in Serbia through the acquisition of assets from Gorenje MDM. CMS Belgrade provided assistance in this expansion.

•OTP Fund Management and OTP Banka Srbija have jointly acquired ILIRIKA DZU, the Serbian subsidiary of ILIRIKA group, bolstering the Serbian capital market and solidifying OTP Group's presence. Karanović & Partners acted as lead counsel for OTP Group.

•Slovenia's Samsic Holding, a member of the French Samsic Group, has acquired the remaining 45% stake in Belgrade-based Samsic STM, a facility management and construction services provider.

•Slovenian chemicals company Melamin plans to absorb non-woven fabrics unit SmartMelamine.

•Austrian refractory products manufacturer RHI Magnesita has successfully acquired Seven Refractories, a Slovenian alumina refractory mixes supplier, for a reported EUR 93 million. The acquisition adds approximately 240 employees and expands RHI Magnesita's global network with production sites and sales offices in multiple countries.

•Rucio Investment, based in Luxembourg, has submitted a buyout bid for Slovenian software developer Datalab Tehnologije, proposing to acquire remaining shares at EUR 11 per share.

•Slovenian bank Nova Ljubljanska Banka (NLB) has received authorization from the European Central Bank (ECB) to merge with its subsidiary N Banka, which was previously acquired from Russian lender Sberbank.

•Muhr und Bender, a subsidiary of Mubea, has acquired RUAG International Holding's aerostructures activities in Oberpfaffenhofen and Eger, advised by Hengeler Mueller.

•Poland's Selena Group is teaming up with Hungary's Masterplast to set up a glass wool factory in Szerencs. Selena will acquire a 50% stake in the project, involving a close to EUR 10 million capital increase, as part of their strategic collaboration.

•The Rubix Group, a London-based industrial distributor in Europe, has acquired Hungarian distributor Tar Csavar-Csapagy, specializing in tools and maintenance products. Noerr advised the Rubix Group on the acquisition, while Deloitte Legal reportedly advised the sellers.

•Croatian shipping company Tankerska Plovidba now holds a 96.05% stake in hotel owner Turisthotel following a successful takeover bid in which it acquired 1.40% of equity capital.

•Croatia's CERP has initiated the sale of government minority stakes in five local companies through open bidding auctions, including a 14.64% shareholding in Slavonija Zupanja with a starting price of EUR 694,000, a 0.005% stake in Hotel Croatia in Cavtat starting at EUR 2,340, a 0.005% stake in Jadranski Luksuzni Hoteli in Dubrovnik at EUR 3,900, a 0.12% stake in Olympia Vodice for EUR 11,070, and a 0.001% stake in Luka d.d. Split for EUR 54.

•Croatian retailer Studenac has acquired Spar Trgovina, adding 40 stores to its portfolio and expanding its presence in continental regions.

•British aviation services company Menzies Aviation is set to acquire a majority stake in Bulgarian firm Cargo Handling Services (CHS), based at Sofia Airport, expanding its air cargo business and entering emerging aviation markets.

•Bulgarian insurance broker SDI Group is set to be acquired by US financial technology and insurance company Acrisure, facilitated through its Polish subsidiary Unilink.

•Olympia Group, guided by Koutalidis in collaboration with CMS, has acquired the remaining stake in Triathlon Holding through its subsidiary Sunlight Group.

•Intrum Holding AB (Intrum) has concluded a securitization deal for Piraeus Bank's Project Senna non-performing loan portfolio, with legal support from White & Case LLP. The portfolio, valued at EUR 300 million, consists mainly of small-sized mortgages and consumer/small business loans.

•Estonian energy company Eesti Gaas has completed the acquisition of all shares of natural gas distribution system operator JSC Gaso, making Eesti Gaas the sole shareholder. Ellex has advised the deal.

•BaltCap Private Equity Fund III and Draugiem Capital are set to acquire a controlling stake in Latvia's Pepi Rer SIA, known for its IGLU soft play brand and ProVent floor insulation brand, aiming to enhance global expansion efforts. COBALT is providing legal support on the transaction.

Czech retail investment fund Investika Realitni Fond has acquired Warsaw's Royal Trakt Offices from Patrizia SE. Dentons provided advisory to Patrizia.

International mobility service provider Sixt has acquired Renti Plus, a car subscription platform based in Latvia. The acquisition includes over 100 cars.

Bosnia's Telekom Srpske has acquired local peer Trion Tel.

Volex is set to acquire Murat Ticaret for around EUR 178.1 million, with legal support for Macedonian aspects provided by Karanovic & Partners.

Maritime technology start-up DeepSea Technologies has been acquired by Nabtesco Corporation, a Japanese engineering company listed on the Tokyo Stock Exchange. Zepos & Yannopoulos provided advisory support for the acquisition.

Norway's Inspera has acquired Kosovo-based Crossplag, a plagiarism and AI content detection company, with advisory support from RPHS Law.

🇵🇱Cargounit, a leading locomotive lessor in Central and Eastern Europe, has secured a complex financing package of up to EUR 338 million, including a sustainability-linked loan for purchasing eco-friendly locomotives, with advisory from Clifford Chance.

🇵🇱Emitel S.A., the largest terrestrial radio and television infrastructure operator in Poland, has secured financing of up to EUR 353 million from a consortium of financial institutions, including term, investment, and revolving loans. White & Case LLP provided advisory support to the lenders, including Bank Handlowy w Warszawie, PKO Bank Polski, and others.

🇪🇪Formaloo, an Estonian-based company offering a collaborative platform for business application development, has raised EUR 2 million in an investment round led by Change Ventures, along with participation from Hyde Park Venture Partners, Mana Ventures, and Startup Wise Guys. Cobalt provided advisory services for the transaction.

🇱🇹PVcase, a solar energy software startup specializing in the design, evaluation, and optimization of commercial and utility solar assets, has secured EUR 91.1 million in a Series B funding round with investment from Highland Europe, Elephant, and Energize. Cobalt provided advisory support for the investment.

🇨🇿City Home Finance establishes a a 10-year secured bond programme of City Home Finance III, s.r.o. with a value of up to EUR 41 million, advised by Allen & Overy.

🇷🇴High-Tech Systems & Software (htss) has launched Telemedica, a virtual clinic Software as a Service (SaaS) platform, following a EUR 0,5 million investment, targeting medical units in Romania to expand their patient base and reach.

🇵🇱Eko-Okna S.A. received credit loan financing of approximately EUR 357 million from a consortium of Polish banks (Bank Polska Kasa Opieki S.A., Santander Bank Polska S.A., Powszechna Kasa Oszczędności Bank Polski S.A., BNP Paribas Bank Polska S.A., and ING Bank Śląski S.A.), advised by Norton Rose Fulbright.

🇧🇬🇷🇴🇬🇷TBI Bank, a financial technology bank operating in Bulgaria, Romania, and Greece and a part of the 4Finance group, has successfully completed the public placement of its EUR 10 million first tranche of senior non-preferred MREL bonds due 2026, with advisory support from Eversheds Sutherland Bulgarian member firm Tsvetkova Bebov & Partners.

🇧🇬Next Basket, a Sofia-based company specializing in the development of a comprehensive 360-degree e-commerce platform, has received an investment from the Innovation Capital Fund, with legal advisory provided by Gugushev & Partners.

🇸🇰DealMachine, a company specializing in real estate investor-oriented solutions, has secured a seed round investment from Vision Ventures, a Slovak venture capital fund. The transaction was advised by Majernik & Mihalikova.

🇧🇬ENERGO-PRO issued EUR 300 million senior unsecured notes due 2035, backed by certain subsidiaries' guarantees and further supported by a guaranty from the United States International Development Finance Corporation. White & Case provided legal counsel for the transaction.

🇷🇴Holde Agri Invest has secured credit facilities totaling RON 30.5 million and EUR 26.7 million from Banca Transilvania and OTP Bank Romania for various purposes, including working capital, equipment acquisition, and modernization. Tuca Zbarcea & Asociatii advised the financiers, while Filip & Company assisted Holde Agri Invest in the transaction.

🇺🇦The "Kovalska" Group has secured a EUR 27 million loan from Invest International to finance a new aerated concrete production plant in Ukraine, with legal advice provided by INTEGRITES.

🇷🇴Geely Holding Group and Geely Automobile Holdings have been advised by Jones Day and Musat & Asociatii on their binding 50/50 joint venture agreement with the Renault Group, aimed at establishing a new powertrain technology company.

🇭🇺Hungarian start-up Axoflow has secured a EUR 2.28 million seed round co-led by Credo Ventures, 500 Emerging Europe, and Notion Capital, with participation from several CEE angel investors.The deal was advised by Cytowski and Partners, with Diamond Law reportedly advising 500 Emerging Europe.

🇷🇴Cerealcom, a Romanian grain and oilseed producer, secured a EUR 100 million revolving credit facility advised by CMS and led by Banca Comerciala Romana and Erste Group Bank AG, supporting the expansion of its logistics and purchase base. BCR provided EUR 70 million, and Erste contributed EUR 30 million.

🇵🇱Eurocash S.A., a prominent FMCG distributor in Poland, and its franchise network have received EUR 0.22 million in financing from a consortium of banks including Santander Bank Polska, Alior Bank, Bank Gospodarstwa Krajowego, Bank Ochrony Środowiska, Bank of China, BNP Paribas Bank Polska, EBRD, and mBank. Clifford Chance provided advisory services for the refinancing of existing debt and financing of current operations in this transaction.

🇵🇱Startup OASIS Diagnostics has secured nearly EUR 3.1 million for further development in a financing round, with Vinci S.A. Hitech S.K.A., a fund owned by Bank Gospodarstwa Krajowego, taking up all the shares. DZP provided advisory services in the financing round for OASIS Diagnostics.

🇷🇴RCS & RDS and its subsidiary DIGI Spain Telecom S.L.U have contracted a EUR 100 million four-year term loan, facilitated by assistance from Filip & Company.

🇸🇮🇲🇪BDK Advokati Advises NLB Slovenia and NLB Montenegro on EUR 24 Million Loan Agreement for BIG CEE.

🇲🇪Israeli BIG CEE's acquisition of the Capital Plaza business and residential complex in Podgorica, Montenegro, has been facilitated by a EUR 24 million loan agreement with NLB Slovenia and NLB Montenegro, with advisory provided by BDK Advokati.

🇱🇻Hepsor sells multifunctional business complex StokOfiss U30.

🇧🇬Black Sea Property is set to acquire Bulgaria's Grand Hotel Varna for EUR 28 million.

🇺🇦The Agrosem Group has secured a EUR 9.6 million financing from the European Bank for Reconstruction and Development for the development of a grain transshipment complex. Asters provided legal advice on the transaction.

🇸🇮Trigal RE Fund has acquired the Situla commercial building in Ljubljana from Centauro Holdings, with legal advisory provided by Fatur Menard.

🇬🇷Everty, under the guidance of Koutalidis, has acquired two logistics centers covering around 33,000 square meters in Aspropyrgos, as part of its expanding international investment portfolio.

🇬🇷Sponsors Aktor Concessions and Intrakat have secured a PPP project financing for the West Peloponnese Kalamata-Rizomylos-Pylos-Methoni road construction, operation, and maintenance. The financing involves a common secured bond loan of up to EUR 216 million from Alpha Bank, the National Bank of Greece, and Eurobank. Koutalidis law firm provided advisory support.

🇵🇱Cornerstone Investment Management, in collaboration with a joint venture partner, has received legal advice from Dentons for the financing of their acquisition and capital expenditure for the Warta Tower office building in Warsaw from Globalworth. The transaction, valued at over EUR 63 million, was facilitated by Santander Bank Polska and Erste Bank.

🇵🇱Goodspeed, a portfolio company of Enterprise Investors and a leader in Poland's diet catering sector, has acquired Caterings, an IT software provider for the catering industry, as part of its growth strategy. Gide Warsaw provided legal assistance for the acquisition.

🇧🇬Israel's Econergy seeks to buy up to 150 MW solar PV projects in Bulgaria.

🇵🇱PV Energy Projects has secured financing from Bank Pekao for the construction of 36 photovoltaic farms with a total capacity of 67.7 megawatts across eight voivodeships in Poland. SSW Pragmatic Solutions provided advisory services to PV Energy Projects, while Norton Rose Fulbright advised Bank Pekao.

🇭🇺BayWa AG Sells Szarvas Biogas Power Plant to Hungary's MOL Group with Legal Support from Pontes Budapest.

🇧🇬US Investor Bulgaria Solar Acquires Chernogor Photovoltaic Project from Global Financial Consulting with Legal Counsel from CMS.

🇵🇱Iberdrola Acquires 50 MW Wind Farms from Augusta Energy, advised by DWF.

🇵🇱GreenVolt Power has entered into preliminary agreements to sell shares in renewable energy project companies to Energa Wytwarzanie S.A. The deal involves the Sompolno hybrid project (wind and photovoltaic farms) and Opalenica photovoltaic farms, totaling 58.6 MW. WKB lawyers provided legal support throughout the auction process.

🇭🇺Kommunalkredit secured a EUR 37.5 million financing for the 63 MW Senyo photovoltaic plant in Hungary, with advisory assistance from PHH and Dentons, while CMS reportedly advised project commissioners Green Source and Core Value Capital.

🇷🇴Enel Green Power Romania has acquired a 63 MW photovoltaic park in Călugăreni, Giurgiu county. The deal was advised and facilitated by Clifford Chance Badea.

🇵🇱Warsaw, Poland

PwC

Manager w zespole podatkowym Deals

Page Executive

Finance Director / CFO (regional)

Michael Page

Accenture Poland

CFO&EV– Risk Consultant (ICH Europe)

🇨🇿Prague, Czechia

R3SEARCH Recruitment

BDO Czech Republic

Manager/Senior Manager pro oblast fúze a akvizice (M&A)

🇺🇦Kyiv, Ukraine

Kyivstar

🇭🇺Budapest, Hungary

KPMG

TAPASZTALT ADÓTANÁCSADÓ - TÁRSASÁGI ADÓ, M&A ADÓ TERÜLETEN

MOL Group

Senior Group Strategy and M&A Analyst

🇷🇴Bucharest, Romania

PwC Romania

Mergers and Acquisitions Consultant

🇬🇷Athens, Greece

PwC

Corporate Finance Senior Associates / Managers

Motor

🇷🇸Belgrade, Serbia

PwC

Senior Manager for M&A - Deals

Keprom Grupa

🇭🇷Zagreb, Croatia

Funded.club

Chief Financial Officer (Remote)

Native Teams

Chief Financial Officer (Remote)

🇨🇾Limassol, Cyprus

Centro (Ortnec)

Sarajevo Energy and Climate Week 2023 – SECW

25.09.2023 - 29.09.2023, Sarajevo, Bosnia and Herzegovina

Sarajevo Energy and Climate Week aims to address the challenges and opportunities in the energy sector, focusing on topics such as just transition, strategic energy and climate, financing, economy integration and digitalization, and innovation in areas like heating, cooling, and e-mobility.