M&A in CEE - Ed.#23

The Twenty Third Edition of M&A Teaser in CEE: Interview with Aventis Advisors: AI in M&A, Emerging Trends; Job Offers in CEE, and Insights on Recent Major Deals

European Technology M&A trends for 2025: “You need to have an AI story”

With technology M&A showing signs of recovery, particularly in CEE, major shifts are underway. We spoke with Filip Drazdou, an M&A advisor at Aventis Advisors, who shared valuable insights on where the market is headed, the role of AI, and the factors that are drawing in global investors to CEE region.

📈 Why is Eastern Europe attracting so much global attention?

International investors are becoming more interested in Central and Eastern Europe, especially in SaaS and IT services. According to Drazdou, “Western European markets are saturated, so investors are scouting new regions with growth potential.”

The recent elections in Poland have also boosted its appeal as an investment hub. “Poland is now more favorable internationally,” he said, with a renewed emphasis on growth opportunities.

💰 What’s happening with tech valuations and deals activity?

While valuations have declined from their pandemic highs, deal activity is picking up. “We’re seeing more buyers interested in deals, and founders who delayed the sale of their business are coming back to the market and saying, “OK, let’s do it now.”

Global SaaS companies tend to be valued at 2-4x their sales, while large US companies today tend to stabilize at 6-7 times. This reflects the industry returning to more normal levels following the volatility of the pandemic years.

M&A activity peaked during the Covid era years of 2020-21, driven by looser monetary policies and low interest rates. Valuations have now eased slightly as revenue is growing “but that also meant companies were able to stay profitable or improve their margins,” Drazdou explained, noting that while valuations have normalized, the market as a whole is rebounding.

Key sectors driving interest in Eastern Europe?

CEE’s automotive industry is a prime target for German investors, given the pressures the carmakers are currently under from higher costs and increasing competition.

“Outsourcing to Poland through an acquisition could cut costs while maintaining a stable European supply chain.”

The IT services market is also thriving, driven by the push for AI-enhanced digitalization. “During Covid, everyone invested in digital. Now, AI is driving another wave of demand for IT services.”

🤖 The AI factor: A must-have for sellers

For businesses looking to sell, an AI narrative has become essential—not just for innovation but to strengthen their competitive advantage.

“You need to have an AI story,” Drazdou emphasized, “in terms of generating more revenue but also reducing costs and improving customer experience.”

AI applications, from customer support automation to development tools like GitHub Copilot, are becoming key differentiators for potential buyers.

“It’s sometimes more about a defensive narrative: explaining to investors why AI will not damage the business and it will still be viable in five years,” he added, showing that even for businesses not centered on AI, having an AI strategy reassures investors about long-term stability.

Example: The recent acquisition by Zillow of a virtual staging tool powered by AI underlines how big players are integrating the capabilities of AI to remain competitive.

⚙️ How is Aventis using AI to transform M&A?

Aventis is experimenting with AI tools to optimize the M&A process, from data gathering to light financial analysis. Tools like Perplexity and ChatGPT help expedite tasks, allowing advisors to focus on relationship-building.

📅 Looking ahead to 2025

As for the role of the M&A Advisors in the future, it will become "more about building relationships with buyers and sellers, and helping them navigate the sale journey,” Drazdou shared, emphasizing that M&A isn’t just a numbers game. “It’s emotional —many founders are selling a business they’ve spent 20 years building.”

The AI narrative will continue to be crucial in M&A deals as companies prioritize digital transformation.“We’re expecting a comeback soon, with AI driving another wave.”

Interview conducted by David Moth

Content Director at Ideals VDR

M&A Trends in AI for 2024

Key Drivers in AI M&A

Strategic Acquisitions Surge: Major tech firms like Microsoft, Amazon, and strategic players are acquiring AI companies to gain competitive advantages, integrating AI for enhanced product offerings and operational efficiency.

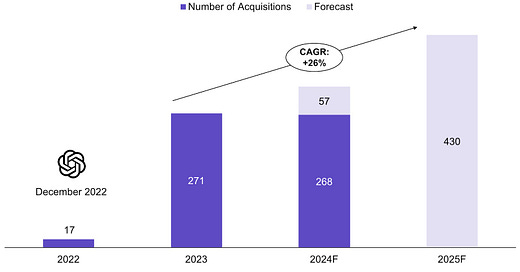

Sector-Wide Growth: The AI M&A market saw 271 deals in 2023 and is forecasted to close 2024 with 326 deals—a 20% increase year-over-year.

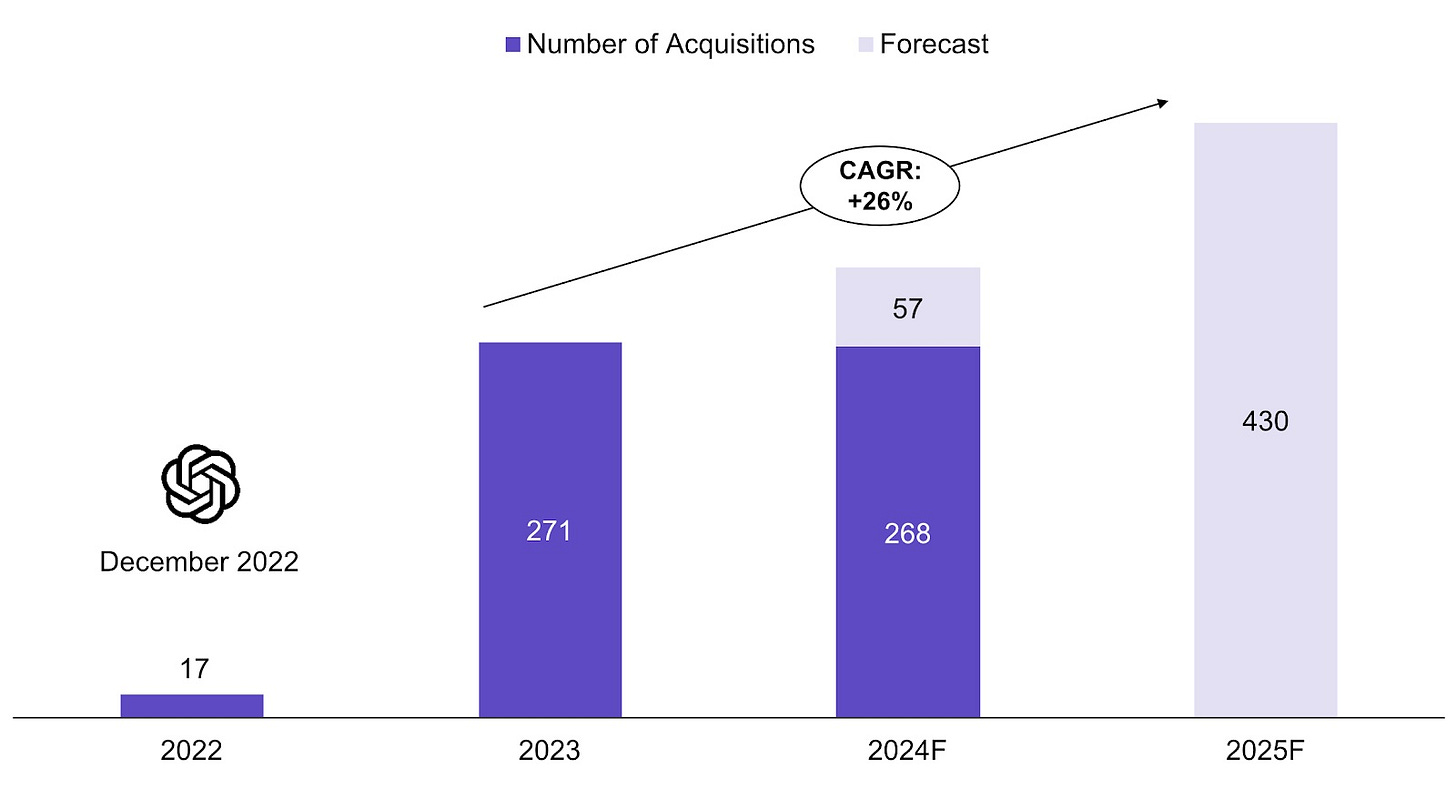

Financial vs. Strategic Acquisitions:

Financial Investors (PEs & VCs): Focus on growth potential and high returns.

Strategic Investors: Target intellectual property and technologies to bolster market position and improve efficiency.

M&A in AI: Total number of AI deals

AI as a Strategic Imperative

Companies face a “build vs. buy” decision with AI, with acquisitions often seen as a faster route to integrate ready-to-deploy AI tech.

Advisory and Service Firms: Increasingly pursuing AI acquisitions to streamline tasks, reduce costs, and improve accuracy—transforming traditional roles and operational models.

M&A in AI: By type of investors

Strategic Benefits of Technology M&A Advisors

For AI companies, M&A advisors bring critical expertise in:

Valuation Insight: Timing exit strategies aligned with market trends.

Process Expertise: Managing M&A details to maximize deal value, helping founders focus on growth while securing optimal outcomes.

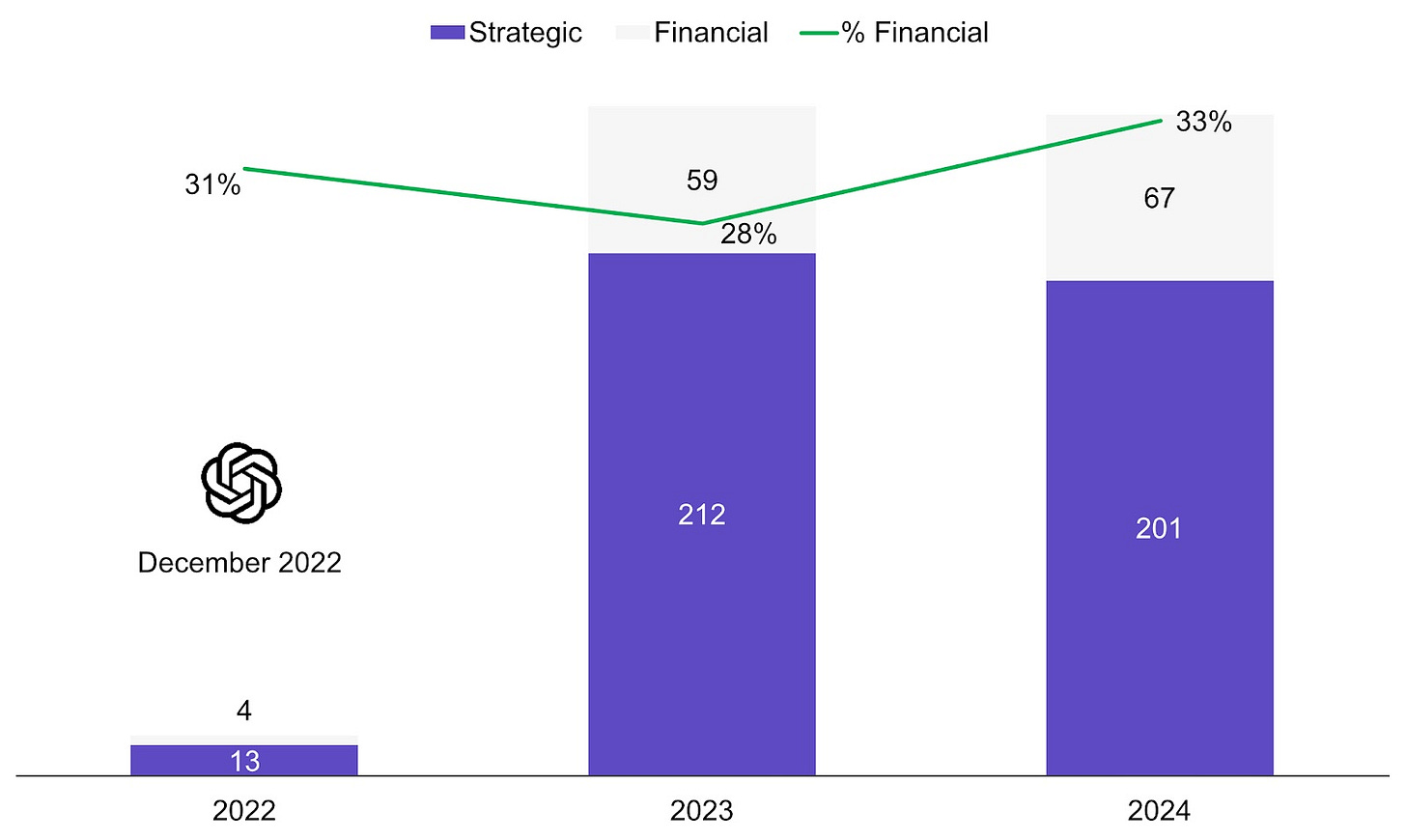

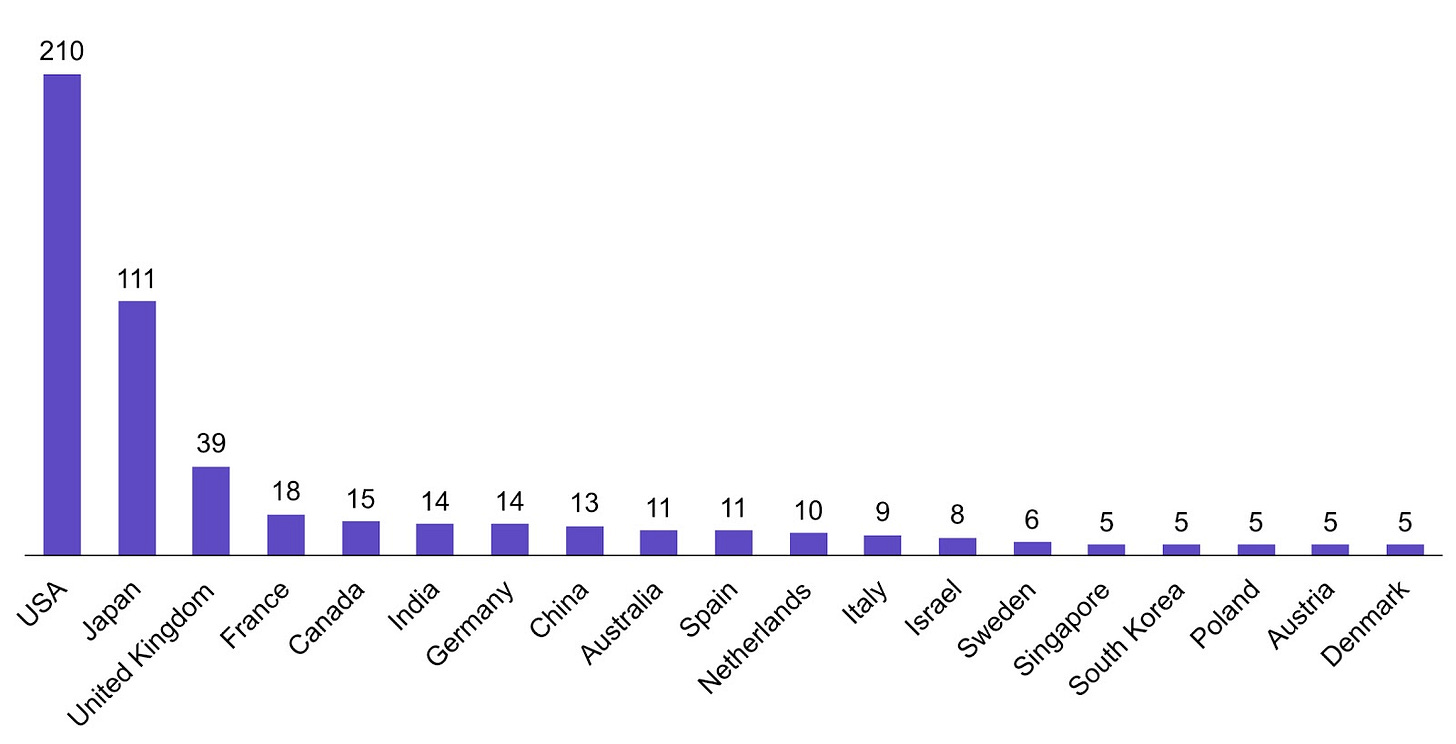

M&A in AI: By country of acquirer

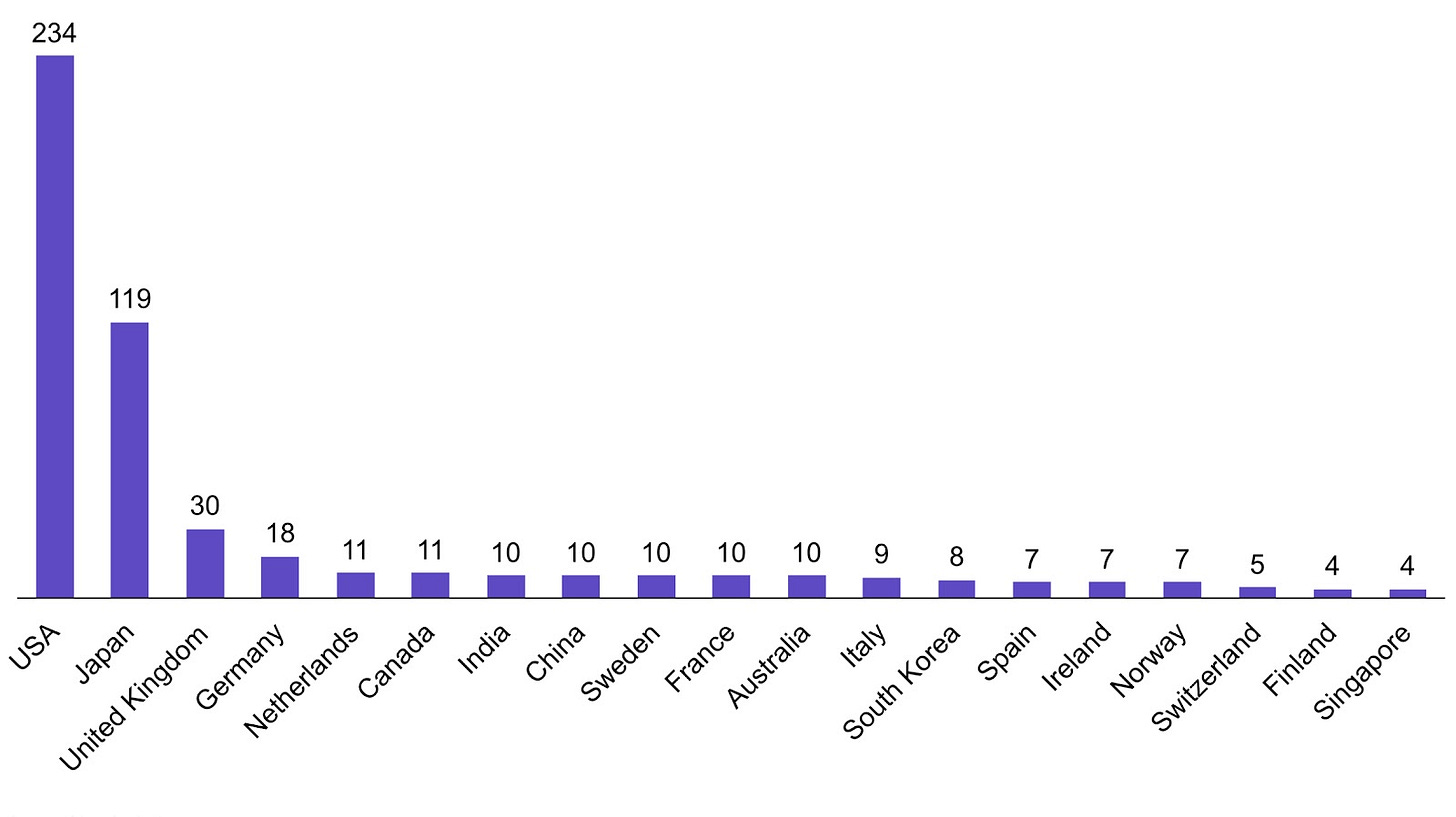

M&A in AI: By country of target

The CEE M&A Teaser is supported by iDeals Virtual Data Room.

We have just recently launched a new interface packed with features, including advanced AI capabilities. To learn more, please, contact me:

elena.frolova@idealscorp.com

🇵🇱Warsaw, Poland

PwC Polska

Menedżer/Menedżerka | Energy Transition

Konsultant/ Konsultantka | Strategy& (Energy Transition)

Menedżer/Menedżerka z jęz. niemieckim | Ryzyko i Regulacje

Aventis Advisors

ZF Group

IT M&A (Merger & Acquisition) SAP Solution Architect

Marktlink

Forvis Mazars

M&A Associate (Corporate Finance)

M&A Senior Associate (Corporate Finance)

🇦🇹Vienna, Austria

Deloitte

Senior Consultant Mergers & Acquisitions

Manager M&A Transaction Services

(Senior) Consultant M&A Transaction Services

🇨🇿Prague, Czechia

EY

People Advisory Services - Transaction/M&A - Senior

Junior konzultant - Finanční Due Diligence (M&A) Junior konzultant

KPMG

Analyst v týmu Mergers & Acquisitions

MOORE

Konzultant/Senior konzultant M&AKonzultant/Senior konzultant M&A

🇺🇦Kyiv, Ukraine

Київстар

M&A manager (B2C,B2B digital companies)

🇭🇺Budapest, Hungary

JPK Trading Kft.

PwC Hungary

Senior Adótanácsadó (Mergers & Acquisitions)

EY

🇷🇴Bucharest, Romania

Deloitte

Senior Associate | Corporate Finance, M&A Advisory

PwC Romania

Manager - Business Restructuring Services_Deals

🇬🇷Athens, Greece

PwC Greece

Deals Transaction Services Manager

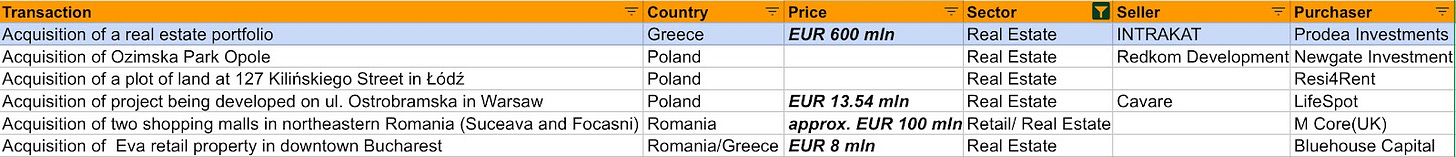

Top Deals by country

Other Countries

🇷🇸Telekom Srbija raised EUR 847 million through a five-year eurobond issuance on the Dublin Stock Exchange at a 7% annual interest rate, with proceeds earmarked for refinancing existing debt.

🇬🇷Metlen Energy & Metals issued EUR 750 million in Green Senior Notes at 4% due 2029, targeting institutional investors, with the listing on Luxembourg's Euro MTF market.

🇵🇱PKO Bank Polski issued EUR 350 million in subordinated capital bonds, qualifying as Tier II instruments upon regulatory approval, with trading set for the Warsaw Stock Exchange’s alternative system.

🇱🇹TPG led a EUR 340 million investment in Vinted, valuing the second-hand fashion marketplace at EUR 5 billion, marking the largest investment in the Baltic startup ecosystem this year and Lithuania’s largest to date.

Fundraising in Real Estate

🇬🇷Alpha Bank financed a EUR 806 million secured bond loan for Athens International Airport, supporting the expansion of Greece's largest and busiest airport.

Fundraising in Energy Deals

🇵🇱A consortium of 16 banks provided ORLEN with a EUR 2 billion dual-currency revolving credit facility to support its ongoing operations.

🇵🇱TAURON Polska Energia secured EUR 668 million in green financing through agreements with BGK, PKO BP, and ICBC to support renewable energy projects, grid development, energy storage, heating infrastructure transformation, and RES-related acquisitions.

🇬🇷Public Power Corporation (PPC) issued EUR 600 million in 4.625% Senior Notes due 2031, with proceeds aimed at funding its ongoing expansion capital projects, and the notes are listed on Euronext Dublin’s Global Exchange Market.

🇲🇪Elektroprivreda Crne Gore (EPCG) plans to invest nearly EUR 300 million over the next three years to expand renewable energy, while navigating the challenge of reducing reliance on the Pljevlja coal-fired power plant, which currently supplies 40% of Montenegro’s electricity.

🇵🇱PKO Bank Polski provided financing for VSB Polska’s 41.6 MW Racibórz onshore wind farm in Poland.

The CEE M&A Teaser is supported by iDeals Virtual Data Room.

We have just recently launched a new interface packed with features, including advanced AI capabilities. To learn more, please, contact me:

elena.frolova@idealscorp.com